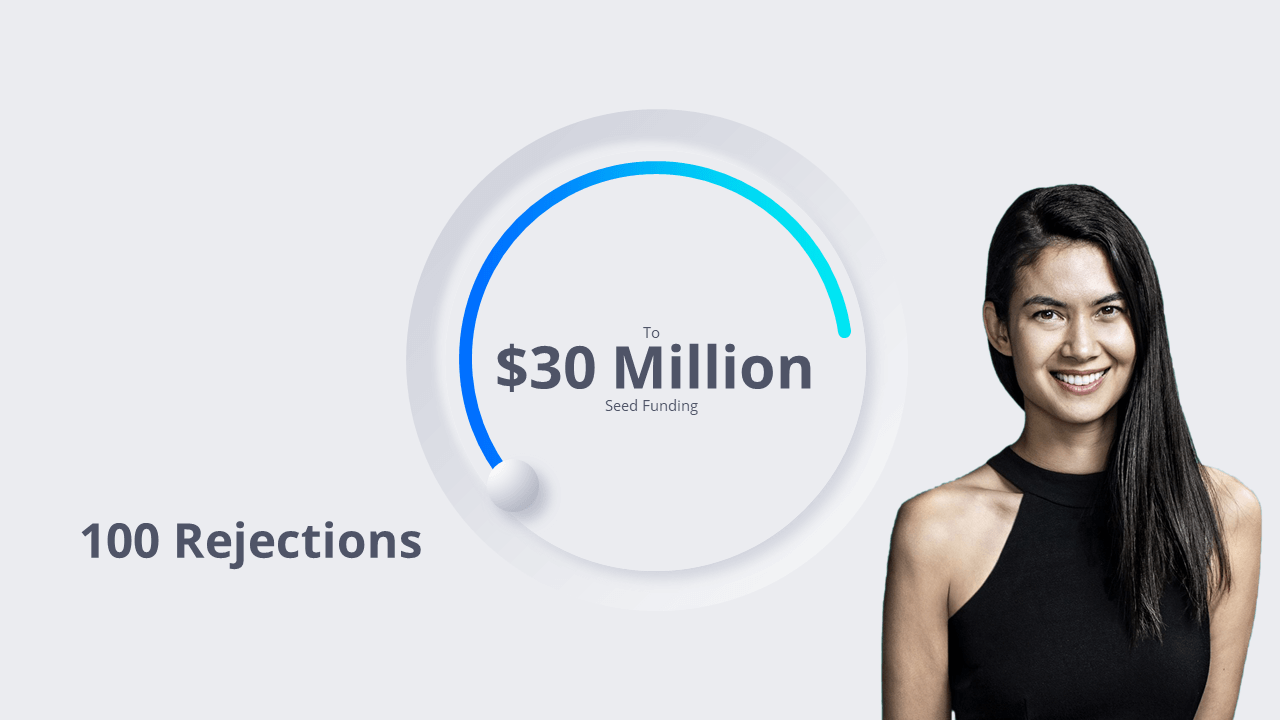

100 failed attempts of fundraising to 40B$ company.

When you are seeking funding for your business, it is important to present yourself appropriately to investors. Investors will ask you a lot of questions so it is important that you become prepared ahead of time for potential questions you will be asked.

Before our first VC meetings, my team sat down and asked each other “gotcha” questions until we were all experts.”

— Neil Thanedar | CEO and Founder, LabDoorMany people are afraid that they will be asked something that they do not know the answer to. If you do not have an answer for something that they ask, it might hinder your ability to get funding. Do your homework and know your business and the hard work and research. Know your business model, plan your strategy, forecast your numbers, understand your industry and the metrics that people care about in your industry so that you are able to answer every question with confidence.

A typical fundraising process can take 3 to 12 months in some cases even more than that. Fundraising can take a lot of time and energy. The best thing you can do as an entrepreneur is to be prepared as much as possible.

Investors are turned off by excuses. Your most important task is to make potential investors feel that you are going to get things done no matter what. Investors back those that prove they can do a lot with a little; those that are

a force of nature. The best way to appear formidable is to actually be formidable. Get it done.

Effective investment seekers understand the rules of storytelling: compelling characters; high stakes; and a clear beginning, middle, and end. Remember that people are more memorable than ideas, so focus on the details

and put your story at the forefront.

What is it about your offering, your approach, your technology and your team that makes your company able to achieve and execute on this opportunity? ” — David Ehrenberg

| Chief Financial

Officer, Early Growth

Once you have proved that you have enough domain knowledge to build what you want to build.

Another question that pops up is whether you are able to do it profitably.

“The best way to tackle this question is to show reasonable estimates for customer acquisition, using well-researched numbers and reasonable

conversion rates. If you can’t explain how you are going to acquire customers for less than what you sell them on average, at a fundamental level, you have failed to explain your business.”

— Patrick Curtis | Chief Monkey and Founder, WallStreetOasis.com

Especially if you are in the ideation phase with no sales or customers yet the biggest challenge would be to convince yourself that you

will be able to compound the money invested in your startup.

Tip* Start selling it on social media before you build it.

As a founder are you able to quantify the risk involved in making this idea and do you have a backup plan to handle it?

“Zaarly raised $14.1 million in a Series A in fall of 2011. But it was a question earlier that spring from Marc Andreessen in our pitch meeting that gave our founding team the most pause, “Why do you think this hasn’t worked in the

past?” We didn’t have a great answer — more of a hunch really that mobile technology didn’t exist to allow the distribution of information in real-time previously. But the question forced us to examine our predecessors who had

tried and failed to learn what landmines to avoid. Our lesson: Know your landscape and learn from prior failures and success. ” — Eric Koester | Founder, Zaarly

This is your chance to demonstrate that you

understand an investor’s perspective and have thought long and hard about what someone has to gain from helping to fund your company. Timing is critical as well: assess what, if anything, a potential investor has to lose from not

backing your company right now.

Can you connect this investment to revenue generation?

Investors expect to earn ROI, but they also understand that some investments take longer to pan out than others. The magnitude of that ROI is key here. A longer wait for

a bigger payoff may speak to them and be something they are more interested in. Other investors could be the opposite. Basically, a short-term loan that expects quicker returns for maybe fewer margins.

Or they might require the best of both worlds–fast and furious.

Do you have a thoughtful plan for how to use this money?

“The most difficult thing to explain to an investor is your plan to grow. They want to know how you’ll outdo everything you’ve already done. Prep by picturing your future:

What staffing or product creation will help you have the business you want to have?” — Brian Moran | Founder/ Director of Online Sales, Get

10,000 Fans

Prepare to explain: Are you seeking capital in order to hire new employees, conduct research and development, expand your offices, boost your sales or marketing budget, or for another purpose entirely? If your objectives

appear ambiguous or out of concert with your business strategy, investors will have a hard time taking you seriously.

This also involves mapping out goals for these deliverables. What type of end result will they achieve

and how quickly can you get there with this investment?

Did you do your homework on who I am?… Psst! This is a great time to stroke the ego.

What makes the investor you’re speaking to the perfect partner for your company? What drew you to this person or group in the first place?

Maybe the investor in question isn’t your first (or even fiftieth) choice, but they should feel like your presentation was tailor-made for them. Do your due diligence, know what sets your target apart, and help them connect the

dots.

Pitching investors is not easy. The more often you do it, the better you will get, and the calmer you will feel when they ask you something you don’t expect.

As you pitch more investors (it is not uncommon for someone to have

to pitch hundreds of investors before getting all the money they need) create additional slides for your pitch deck that contain the information asked by previous investors.

Leave those slides in the appendix of your business

plan, ready and available for the next time the question gets asked. If there are offshoots of information that you gather from a pitch that makes the answer to a question even better, include it in your information so you remember

it for next time.

It’s always good to continually improve and refine your pitch and approach. The more you understand your business, the growth levers, the cash levers, and the expenses, the better your conversation with

investors will be.