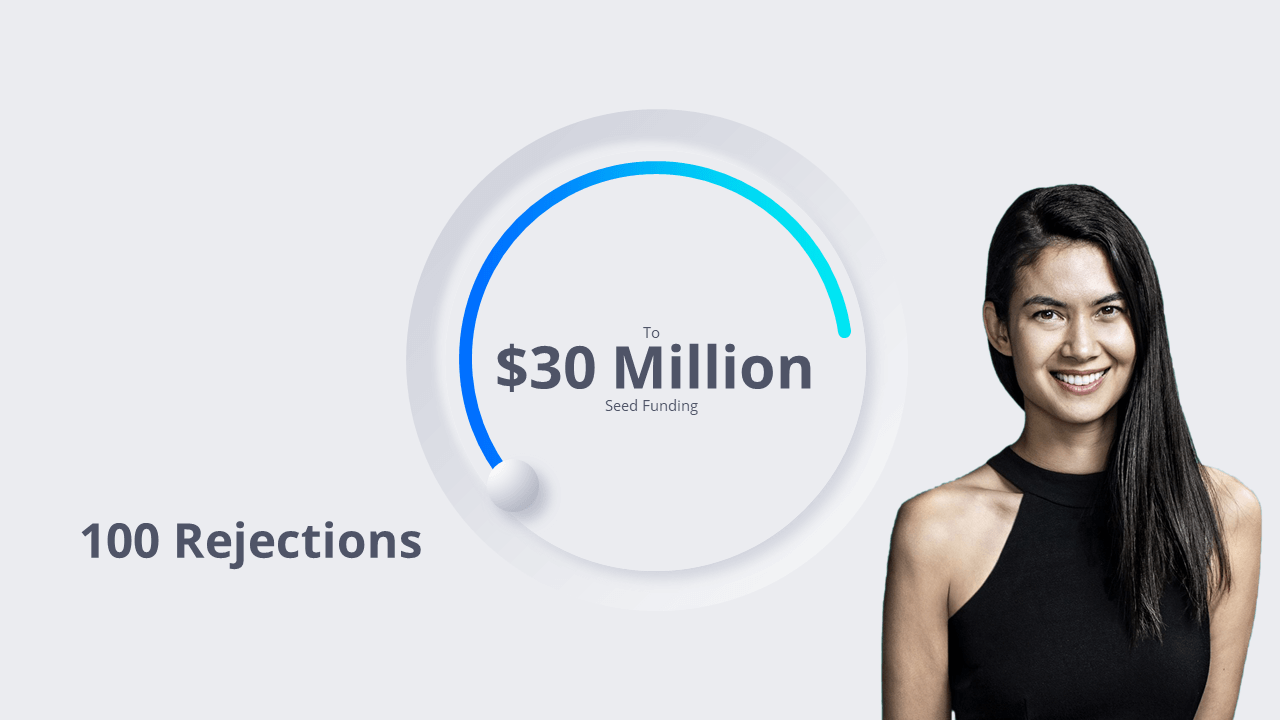

100 failed attempts of fundraising to 40B$ company.

Stats from Crunchbase show that more than 1,900 seed and series A investment rounds happened in June–August 2020, despite it being the peak of the coronavirus. Even a pandemic couldn’t discourage entrepreneurs from seeking capital to fund their dreams.

I think it’d be fair to say that investors have been more cautious than usual as markets have softened globally as a result of COVID-19. Entrepreneurs should be able to seek the money they need to ensure the success of their business. However, many of them have trouble deciding whether it’d be a good idea in the first place.

Dealing with VCs can sometimes feel like you are embarking on a treacherous journey because you may be at a disadvantage when it comes to negotiating a good deal. However, seasoned serial entrepreneurs will tell you that it is possible to get capital as and when you need it, without sacrificing your future options. You should know precisely what you are in for before you step into the fundraising process.

I often find budding entrepreneurs wondering whether it’s a good idea to look into VC funding.

I can tell you that each company has its own set of circumstances. So, if you are asking whether your business should or shouldn’t raise capital, I won’t be able to give you a yes or no answer. Instead, I recommend the following simple and practical framework

to figure out what’s right for you.

First, you need to be very clear about what it is exactly you need money for.

If you have no idea what to do with money then don't think about raising, instead work on your product and company.

If you have an idea then make sure it’s not from the following.

“As a VC, I have sat through many presentations like this, and in most cases, the service is actually interesting and compelling. However, in the majority of these presentations, there is little or no focus on how much it will cost to acquire customers. As I ask questions to understand the thinking, what usually comes out is something vague along the lines of web marketing, and/or viral growth with no numbers attached.”

To answer this question you need to understand

Knowing where you are in your journey will help you reach out to the right people when it comes to raising funds for your startup,”

Once you are clear on the stage at which your startup is, it's good to know that you can raise funds at any of these stages.

The more of these things you have the better it gets.

Now the important thing is to figure out

Most Common for startups just at the idea stage.

Mom and dad, granny pop, rich uncle's people who have a little bit of extra money that they can give you because it feels good.

Accelerators are basically Investors with an education program attached to them.

They help you initially + provide some seed funding + prepare you to help you raise more funds from other partners and investors.

Some of the well-known accelerators are

What founders need to know is that there are 1000’s of accelerators and not all of them are good. Some of them even hurt companies because If there is no progress after the accelerator investors might think “hmmm what's wrong with this company it might not be the money but the founders.”

Some of them have Never funded any company outside their own accelerator.

Think: why should I take money from someone who has never done anything in the field or never seen any of these things work.

These are basically rich people with time and money in their hands.

It's easy to get in front of professional angels.

Before reaching out to them, do some research and see if they are active investors or not.

Have they made an investment in the last 6 months, 12 months, 5years?

If they have not invested in a year or two they are probably not investing actively.

So probably not a good idea to waste your time chasing them down.

Seed investors are supper professional angels who have raised funds from outside to invest in startups.

They generally invest on the behalf of angels who probably don't have enough money or time.

These can also be newer but professional investors who are trying to learn the ropes.

They are often great, recent founders, they are probably aggressive about finding good deals, quick processes, because they know they have to move quickly.

There are VC funds that invest millions of dollars and then there are VCs that invest billions of dollars. They're not only investing their money into your business, but they invest their brand too.

VCs have a specific structure for what they do and how they make decisions.

They have multiple partners who tell them hey we need you to invest our money and give us X% of returns.

This type of funding comes in later stages, series A.

So if you are already a startup with seed funding you might need not worry about how to reach them.

When a Vc invests in a company they are not only looking for a huge return but something that can cover their whole fund.

A syndicate: where one person has money from a bunch of other people. Who says we are gonna invest in this thing and everyone else follows.

These are Wide open listings: they will list you and people will send you money without ever meeting with you. This is good if you cannot figure out another way to find funding.

It is not a good way because generally, it does not exist and even if it does exist it will become a nightmare to manage all the individual tiny little investors on your cap table.

This article has been possible because of Y-combinator and Aaron harris (Founder, Investor, Former YC-Partner ) we thank them for sharing so many valuable insights with the startup community.

At last, most investors are receptive to cold emails. The challenge is to get those emails right as there are good ones and bad ones. Attaching a quick and crisp pitch helps in a better response as gives the potential investor the idea about everything they would want to know initially without much effort.