100 failed attempts of fundraising to 40B$ company.

Stats from Crunchbase show that more than 1,900 seed and series A investment rounds happened in June–August 2020, despite it being the peak of the coronavirus. Even a pandemic couldn’t discourage entrepreneurs from seeking capital to fund their dreams.

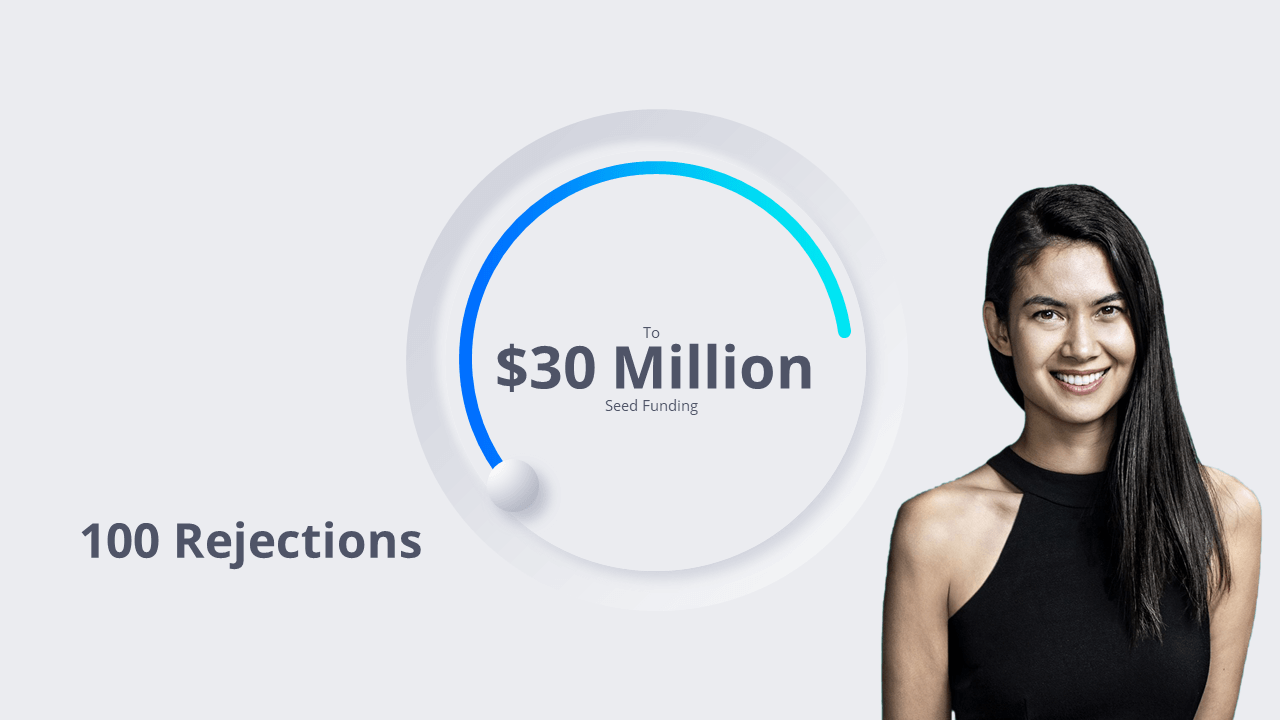

Kathryn Minshew would say very hard as she was rejected 148 times before raising almost $30 million.

Minshew is the co-founder and CEO of job-search and career-advice site The Muse.

Melanie Perkins, founder of canva, which is now worth $40 billion had to hear no more than 100 times.

According to Digital Trends, Adaptive Insights founder was turned down for funding by at least 70 VCs

Ring first appeared on Shark Tank as ‘Doorbot’. Only one shark (Kevin) made an offer. One that was so low it was turned down by founder Jamie Siminoff. He says he nearly cried that day. He lost count of the number of rejections from investors after that.

Recently Ring sold more than 144,000 units in a single day on QVC. The volume was worth $22.5 million in just 24 hours.

Will Herman says he struggled a lot and put in a ton of time trying to fundraise for his startup. He spent around 50% of his time just trying to get the capital needed for the venture in the first year. Just to get a check for $50,000.

Statistics show that the second largest reason why startups fail (29% of cases) is due to running out of funding and personal money.

So what is the difference between those who successfully raise funding for their startups and those who do not?

Melanie Perkins says when she was pitching to a multitude of investors in the early days, she developed her pitch following every single rejection, taking on the feedback that was handed down.

“Every time we were rejected or had tricky questions we’d improve our pitch decks,” she says.

So definitely presentence and developing a strong cover against rejection is a must.

Download Senneca, a pitch deck created for startup founders' practice, feedback, review, and iteration loop.

Here are 5 things we can implement in our pitches

Getting people to care about the solution requires that they care about the problem. Entrepreneurs are often so enamoured of their solution, they neglect to clearly explain the problem their solution is built to solve.

Perkins realized that she was diving into a technical solution before articulating an emotional problem. And the problem was best told through storytelling.

"A lot of people can relate to going into something like Photoshop and being completely overwhelmed," she said. "It's important to tell the story because if your audience doesn't understand the problem, they won't understand the solution."

Perkins said that once she shared her story with investors, it was a "transformative moment" for Canva.

“In our earliest pitch decks we talked about our product in our first few slides, but in the end, the majority of our pitch deck explained the problem and its magnitude. - Melanie Perkins

Eventually, canva succeeded in raising a $3 Million seed round from world-class investors

Entrepreneurs are execution machines every day they have to figure out how to build the product, how to sell, how to hire, they need to do all these details they are very good at talking at this level.

Few Entrepreneurs are good at stepping up one level and talking about their company vision; what they're trying to do. They need to do that because they need to talk to their employees right, they need to talk to their team.

What most entrepreneurs are not great at talking about the top, which is how the world is changing, but investors live at that level because they are not building anything every day or every week they are meeting a lot of different people who are thinking about how the world is changing and where that creates opportunities and they are trying to find companies that satisfy those opportunities.

The best entrepreneurs do hit the top level, the VC meetings are those where entrepreneurs teach investors something about how the world is changing, how the people are changing, how the user behaviour is changing, how the technology landscape is changing?

So the question is how to do this?

We can start by answering simple questions.

This is a strange thing to say because it seems to make sense that investors are smart and follow a logical line of thinking and they built a logical case, but that's not the case.

Because if you think about it, most of the startups fail which means most of the time investors lose money so instead of being rational they are reasonable they all do some analysis but mostly they are looking for excitement and intuition.

So the question is how to figure out what is exciting about your company and how to tell a story about it?

A simple way to do this is

This is counterintuitive, but there is a good reason to not to do that.

Credibility doesn't set you apart; you remain general and vague when instead you need to be unique and special.

It's scary because people can challenge you. and say you dumb.

Many companies will say we are a B2B Saas business and we built Saas software for company collaboration.

It does not explain anything about you and your business.

But in order to stand out among those 1000’s decks you need to be unique and special.

So how can we do it?

Be specific.

Give the most exciting details and achievements about your team so that people can remember you.

Again this is much easier said than done, but why? Why is it so hard to explain your idea, dream, business metrics, customers, problem, solutions, team, values, ethos, hard work, tons of sleepless nights, sacrifices in to12 slides for a few million dollars?

But the more important question is to understand why it is important.

Let's understand this with a story.

Brandon is a photographer and he displayed three of the best photos in his portfolio, people will look at those photos and say “Brandon is an amazing photographer”.

And if he added the 4th best, 5th best, 10th best people would look at them and say “Brandon is a pretty good photographer”

And if he added his 100 best photos they would look at it and say “Brandon is an average photographer with 3 amazing photos”

The next best and the next best gets weaker and weaker and when you add more stuff to your pitch investors see that they see where the weak point is and worse than that it distracts from the most important things.

“Perfection really occurs when there is nothing left to take away”